In the Field

From the delivery of the largest infrastructure project in Europe, to a unique solution for the treatment of stroke patients, through to the production of high-precision data acquisition cards – three illustrative examples tell the story of projects supported by SERV in 2020.

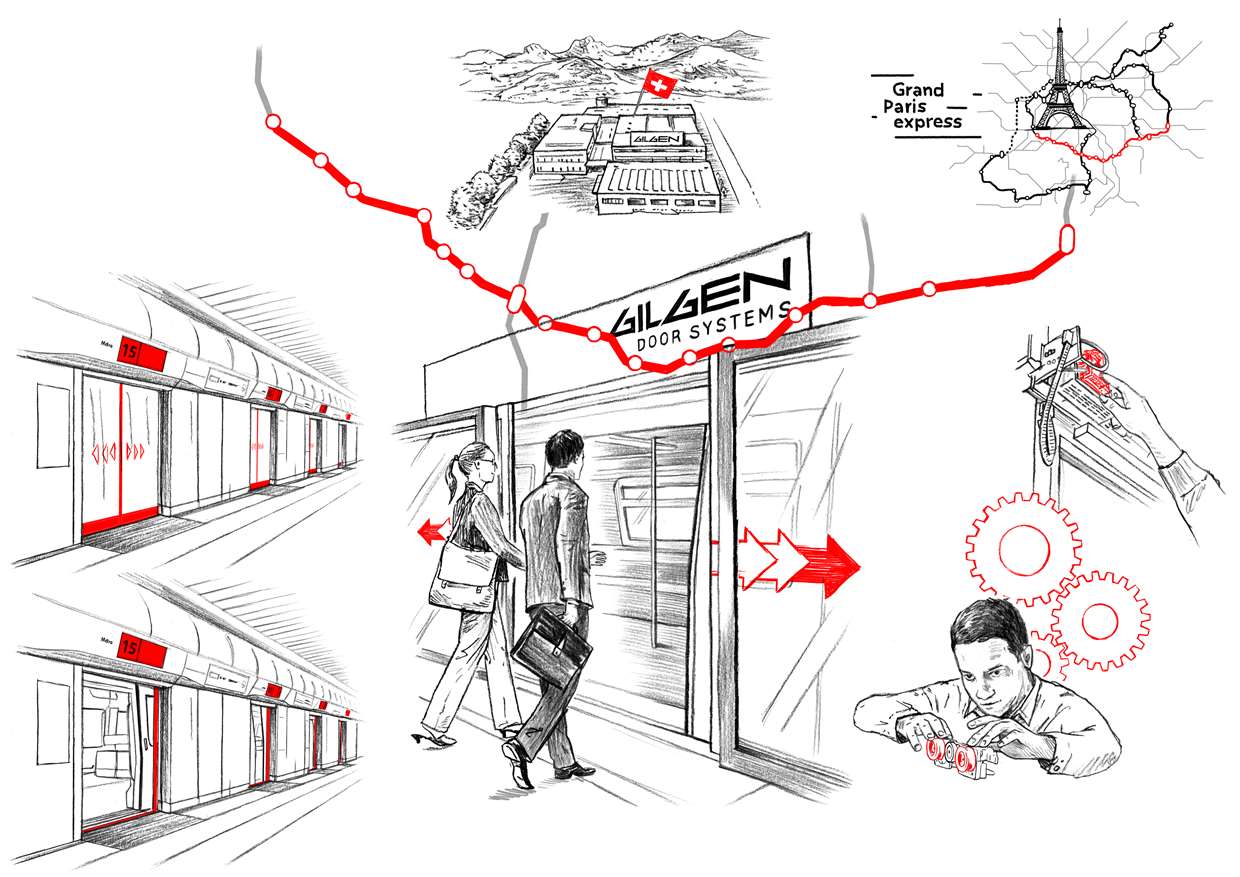

Opening the door for Gilgen Door Systems

The Société du Grand Paris asked its Swiss supplier Gilgen Door Systems AG to provide a six-figure counter guarantee for a term of more than five years. How could the Swiss exporter process this order and still keep liquidity free for other projects?

Paris is currently home to Europe’s largest infrastructure project: the ‘Grand Paris Express’, operated by the Société du Grand Paris founded specifically for this purpose. As part of this project, Paris’ existing metro network is to be expanded to include a further 200 km and four additional lines. The aim is for 68 metro stations to transport around two million passengers every day by 2030.

A reliable partner

Gilgen Door Systems AG (Gilgen), based in Bern’s Schwarzenburg, was awarded the contract to work on this gigantic, prestigious project. Gilgen will be kitting out 16 stations on the ‘Line 15 South’ section with fully automatic doors, with the order value coming in at 42 million euros.

This medium-sized company has more than 60 years of experience in drive and control technology for automatic door and gate systems. When applying for tenders, Gilgen’s reputation as a reliable, competent partner offering high-quality products and services stands the company in good stead. Ultimately, this helped Gilgen win the contract. The decisive factor was its top-notch score in terms of technology and price, says Robert Hug, deputy head of ADP (Automatic Doors for Public Transport).

“We do indeed have enough liquidity, but this means that a large part of it is tied up for the entire term, so we can’t use it for other orders.”

Robert Hug

deputy head of ADP, Gilgen Door Systems AG

The buyer calls the shots

While being awarded the contract is an occasion to celebrate, it also goes hand-in-hand with major challenges: Gilgen needs to comply with an array of highly standardised requirements, all while adhering to a tight time frame. After all, “if a system doesn’t work within a project like this, it’s catastrophic. All you need is a one tiny defect and the entire metro network is brought to a standstill,” says Hug, speaking from years of experience. As a result, the French buyer requested a performance bond amounting to EUR 2.1 million, with a term of 65 months. Gilgen will be paid in instalments, in line with its progress. This means that the last payment will be made in 65 months’ time. In international tenders like this one, the negotiating margin is almost zero. Gilgen does indeed have enough liquidity, “but this means that a large part of it is tied up for the entire term, so we can’t use it for other orders,” Hug explains.

To avoid running low on liquidity, Gilgen applied to SERV for a counter guarantee, combined with contract bond insurance. This sees SERV take on the exporter’s payment risk vis-à-vis the financing bank, leaving Gilgen’s credit limits unaffected. An additional advantage is that the existing guarantee limits for its other ongoing tasks are available in full, meaning Gilgen has more flexibility in terms of pre-financing its business. In short, SERV’s support has opened the door for Gilgen to take on its next large project.

Export Risk Insurance – a Game Changer

MindMaze, a neurotechnology company based in Lausanne, offers a unique solution based on cutting edge neuroscience for the recovery of stroke patients. The demand in the market is high. But for buyers or sellers with tight liquidity, the purchase of equipment poses a great challenge. An insurance offering from Swiss Export Risk Insurance SERV can solve this problem by helping MindMaze offer competitive payment conditions and therefore triggering great sales volumes.

It is well known: a brain is damaged after a stroke. But that is not all. A less known fact is that it shows an increased ability to learn. This mechanism is called hyper-plasticity, which is highly beneficial to a stroke patient’s recovery. However, as time goes by, plasticity decreases limiting rehabilitation to a critical time window.

More than just a game

This is where MindMaze comes in: founded in 2012, MindMaze is a global leader in brain rehabilitation, with a focus on stroke patients, based in Lausanne (Switzerland). “While there are many solutions for brain recovery, MindMaze is the only company that provides an engaging solution tackling objective assessment, personalised cognitive and motor recovery simultaneously and over the full continuum of care to maximise the potential rehabilitation during and after the critical recovery phase,” Jean-Marc Wismer, Chief Operating Officer at MindMaze, says.

Based on cutting edge neuroscience, MindMaze has developed a game-based therapy called MindMotion. Created to promote the kind of movements a patient would typically practice with a physiotherapist, MindMotion is completely customisable to each patient’s needs and progress. Furthermore, the tele-health capability enables it to be used in clinics or at home. The latter allows the patient to train with more frequency and engagement while reducing the time invested by the therapist and therefore reducing the cost of treatment. Jean-Marc Wismer highlights: “Especially in times of the COVID-19 pandemic, this option is highly beneficial.”

“Without SERV’s support, we wouldn’t have been able to sign a deal of this magnitude, especially during trying economic times.”

Jean-Marc Wismer

Chief Operating Officer, Mindmaze

An enabler of growth

After extensive research, CE marking and FDA approval and pre-commercialization in 2016, MindMotion was fully commercialized in 2020. Convinced of the benefits of this product, a distributor in India ordered thousands of MindMotion licences. To enable the buyer to order a larger volume, MindMaze offered a differed payment plan with a long credit period. However, as a young company, MindMaze has limited access to credit lines or to liquidity reserves to take on such payment terms and hence ensure sales growth. This is why MindMaze asked SERV for support, and the company was able to address this challenge efficiently.

SERV covered the transaction with a supplier credit insurance. This product consists of assigning the claim and the SERV insurance to a bank which then partners with MindMaze. For its part, the bank agrees to finance MindMaze upfront against future payments to be made by the buyer “SERV enables growth companes like MindMaze for rapid commercialisation. Without SERV’s support, we wouldn’t have been able to sign a deal of this magnitude, especially during trying economic times,”Jean-Marc Wismer says.

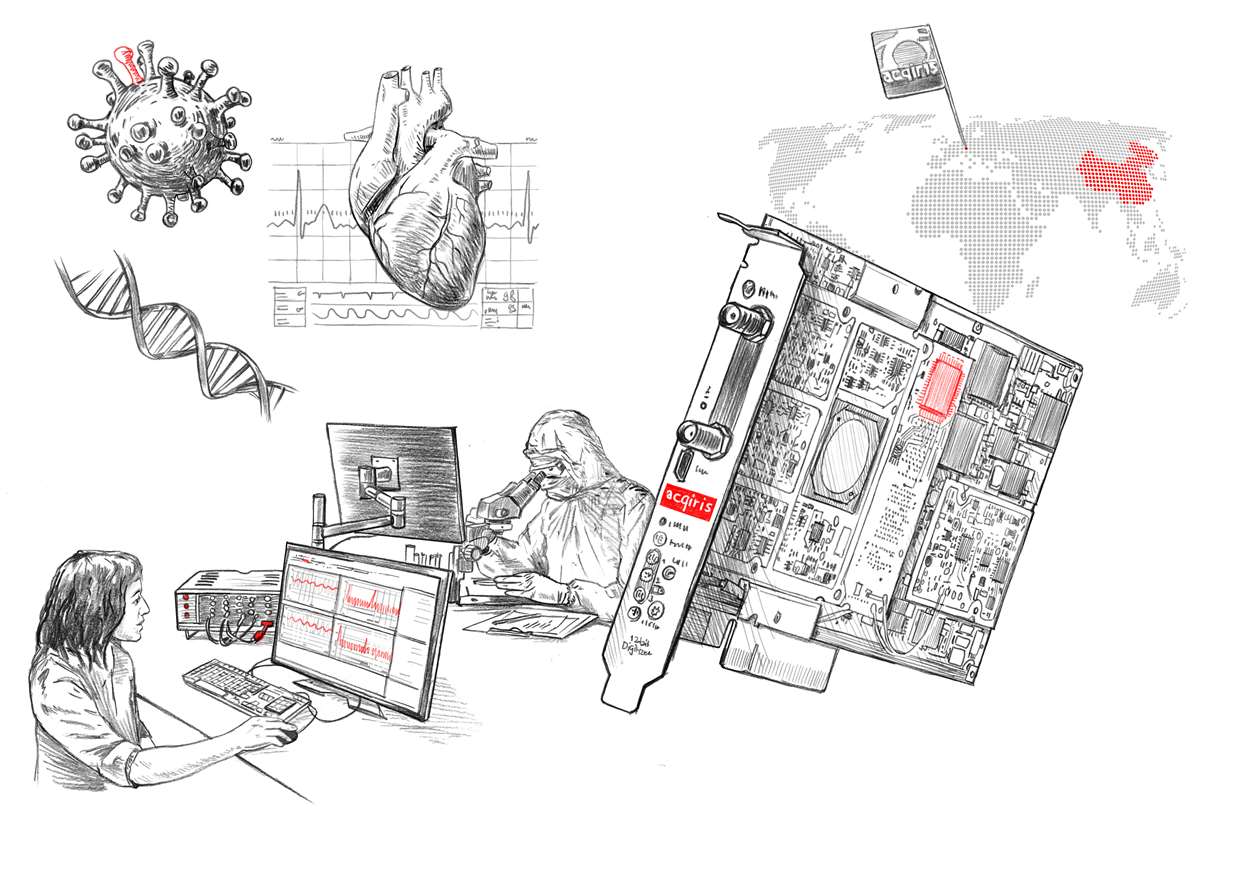

Financing thanks to working capital insurance

An SME based in western Switzerland received multiple export orders worth millions. But when it came to financing production, the company was left facing major challenges. An insurance policy from SERV gave them a helping hand.

Geneva’s suburb of Plan-les-Ouates, renowned for its watchmaking industry, is home to a small business called Acqiris. Acqiris’ data acquisition cards are even more precise than the watches made here: they accurately turn analogue signals into digital data in a billionth of a second. The data acquisition cards are used in all kinds of fields. As components within measuring instruments, they help create digital images in the sub-millimetre range, whether for treating heart disease or fighting coronavirus.

The crux of being awarded a loan

Chinese developers of high-tech medical products also use Acqiris’ cards and have placed orders totalling millions with this SME. As part of these orders, the parties agreed on one delivery per quarter, for several years. The purchaser pays for each delivery, without making an advance payment. This means that Acqiris needs to pre-finance its production costs – and here lies the crux of the matter.

Banks adhere to strict criteria when it comes to giving out loans, and Acqiris does not meet these criteria due to its unconventional history. While this SME, based in western Switzerland, was founded as far back as 1998 and has 22 employees, it was later bought by a multinational firm. It became an independent company once again in 2017 following a restructuring, which is why, officially, it is classed as a young company. “Our new form meant that our company was not old enough and did not have the necessary balance sheets to receive a traditional bank loan,” explains Didier Lavanchy, Acqiris’ co-founder.

Problem solved!

SERV was able to solve this problem: it took on Acqiris’ default risk vis-à-vis the bank via working capital insurance. In turn, the bank issued a loan that enabled Acqiris to pre-finance its production without needing to rely on an advance payment. Pre-shipment risk insurance also protects Acqiris from losses in the event that it needs to stop production through no fault of its own. “Alongside taking on the default risk, SERV’s valuable expertise helped us cover the export risks, which we are delighted about,” adds Didier Lavanchy.

“Alongside taking on the default risk, SERV’s valuable expertise helped us cover the export risks, which we are delighted about.”

Didier Lavanchy

Co-founder, Acqiris